FURY erupted today after the Government bizarrely claimed that National Insurance had not been raised at the Budget – despite Rachel Reeves’ £25billion raid.

The Treasury sparked bewilderment for posting on social media that there were “no increases to rates of Income Tax, National Insurance or VAT”.

The Treasury social media post sparked outrage

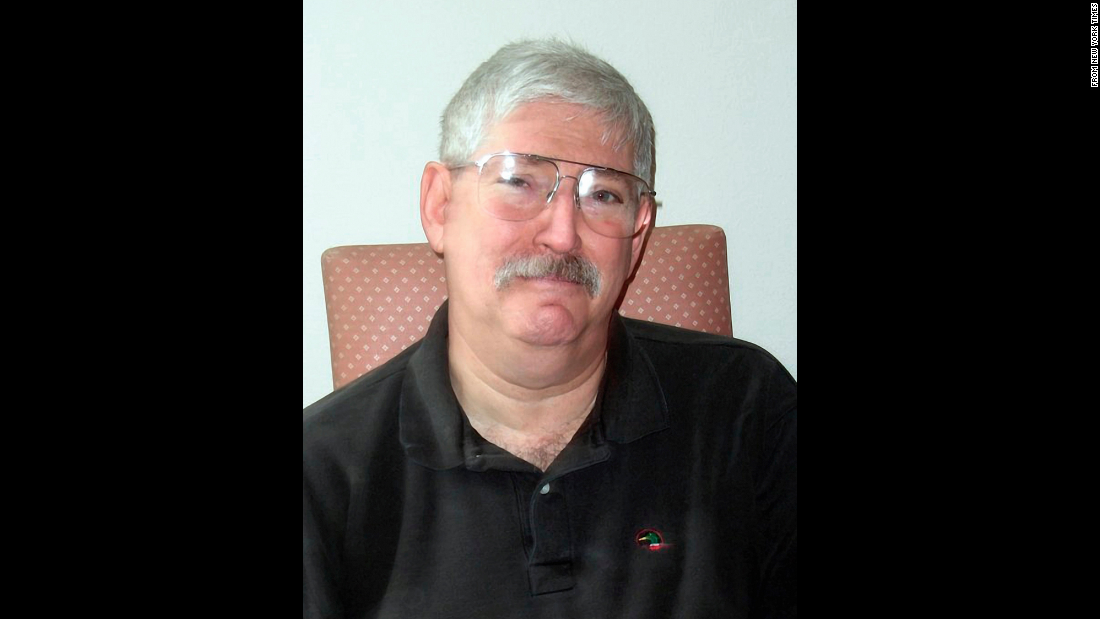

AlamyTory Shadow Chancellor Mel Stride has complained to the Treasury[/caption]

Hiking the employer rate of NICs to 15 per cent and lowering the tax-free threshold to £5,000 as the single biggest revenue-raiser in the Chancellor’s Budget last week.

It is estimated that around two-thirds of the £25billion hit will be passed by bosses onto workers through reduced wage increases.

Incredulous top economist Paul Johnson slammed the tweet, saying: “At best this is dubious. And that’s being generous. Increasing NI was the central tax raising measure in the Budget.”

Tory Shadow Chancellor Mel Stride has complained to the Treasury’s most senior civil servant James Bowler over the “misleading information”.

He asked whether neutral officials were “pressured” into publishing the post by Labour advisers.

Tory MP Jack Rankin said: “Is there not a civil service code of conduct? This is simply untrue.”

Economist Julian Jessop called the claim “grossly misleading”, while SNP Westminster leader Stephen Flynn said: “Why is the Treasury telling fibs?”

Chancellor Ms Reeves used her first Budget to hike taxes by £40billion, the majority of which came from the National Insurance rise.

She insisted she had to raise taxes to put the public finances on a “firm footing” and defended the increases.

She had been accused of breaking Labour’s election pledge not to raise either NICs, income tax or VAT.

Ministers have since insisted that only referred to “working people”, and therefore the increase to employer National Insurance was not a manifesto breach.

The Office for Budget Responsibility estimates around 60 per cent of the rise will be absorbed by workers.

GettyRachel Reeves hiked National Insurance contributions for employers by around £25billion[/caption] Published: [#item_custom_pubDate]