THERE is no dressing up yesterday’s awful figures on government borrowing. Britain is behaving like someone who tries to cope with losing their job by going out on a spending spree on multiple credit cards.

In December alone the Government was forced to borrow £17.8billion, nearly three times what Rishi Sunak’s government had to borrow a year earlier.

ReutersBritain will never get back in the black if we don’t take a chainsaw to our bloated public sector departments[/caption]

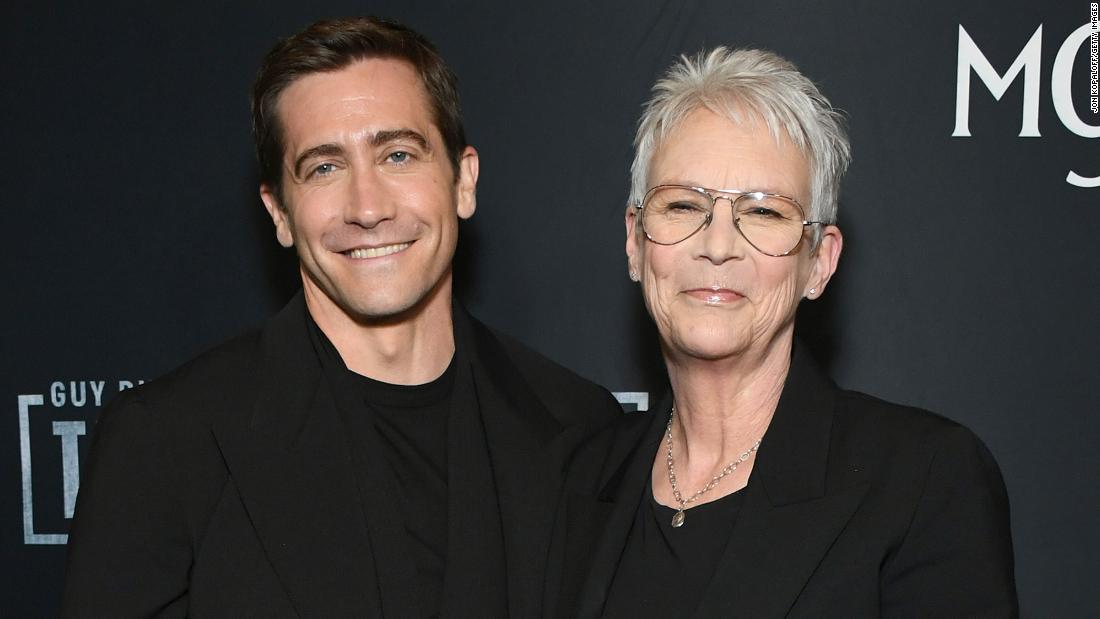

GettyReeves certainly shares some of the blame for the poor state of the public finances[/caption]

As bond markets were telling us when prices of UK government gilts plunged a fortnight ago, the gap between government spending and revenue is becoming unsustainable.

The interest on the Government’s debts is itself costing £100billion a year – more than it spends on either education or defence, and around three fifths of what it spends on the NHS.

We cannot go on like this.

The worse that the public spending figures become, the more that bond investors will start to worry about the Government’s ability to repay its debts and the higher the interest rates they will demand in order to compensate them for the risks.

That, in turn, will push up government spending, making it even more difficult to balance the books, and so on in a vicious circle until the country becomes bankrupt, as several councils have already become.

It is tempting to enjoy Rachel Reeves’ discomfort as, once again, she is caught on a foreign trip while bad economic news arrives back at home.

Davos, the plush Swiss mountain resort where the wealthy global elite meet every January to talk down to the rest of us, is exactly where you don’t want to be seen when the Government is on its uppers.

Reeves certainly shares some of the blame for the poor state of the public finances. Last summer, in one of her first acts as Chancellor, she awarded fat pay rises to public sector workers without even demanding any agreement to accept improved working practices in return.

The pay rises impacted immediately on public spending, yet many of the tax rises she is counting on to pay the extra wages bill — such as higher employers’ National Insurance Contributions — don’t take effect until April.

Even when the tax rises do come in there is no guarantee they will raise nearly so much revenue as Reeves is counting on. As we found out two days ago, when the latest unemployment figures showed a small rise, employers seem to be preparing for higher tax bills by employing fewer people.

Started the rot

But it is no use just blaming Reeves.

The problems with the public finances go back two decades. No government of any colour — Labour, Conservatives or Con-Lib Dem coalition — has succeeded in balancing the public books in 22 years.

Every year since 2003 the UK state has been piling on the debt.

Gordon Brown started the rot. Having begun his term as Chancellor paying off debt he suddenly turned on the spending taps, and ended up running a deficit even when the economy growing strongly. Come the financial crisis of 2008/09 the inevitable happened, and the deficit mushroomed.

David Cameron and George Osborne began well by cutting waste, but then accusations of “austerity” seemed to get to them and they several times pushed back the date at which they planned to get public finances back into surplus.

Another crisis, this time Covid, undid all their efforts. Thereafter, Boris Johnson got the idea the public liked big government and lost all sense of fiscal responsibility.

Some left-wing economists try to maintain that debt doesn’t matter, and that cutting spending, paradoxically, will put a government in a worse financial state.

Yet all that government has achieved in two decades of living beyond its means is to have transferred resources from a productive private sector to a much less productive public sector.

APArgentina’s Javier Milei wielded a chainsaw at his election rallies, to symbolize what he intended to do to public spending[/caption]

PAEvery year since 2003 the UK state has been piling on the debt – Gordon Brown started the rot[/caption]

Those left wing economists appear to think that only government spending can boost an economy. But what we really need is more private investment and fast.

To give her credit, Reeves understands this, which is why she is suddenly promoting the privately-funded third runway at Heathrow, much to the consternation of London mayor Sadiq Khan.

If we can’t get growth into the economy I have little doubt where we are heading.

Two years ago, fed up with a three-digit inflation rate, voters in Argentina in desperation turned to an economics professor and Benny Hill lookalike, Javier Milei.

He had wielded a chainsaw at his election rallies, to symbolise what he intended to do to public spending, and has proved as good as his word. Whole departments of government have been closed, and inflation is finally falling.

Britain, fortunately, is not yet in as bad a position as Argentina has been in recent years. Once one of the world’s wealthiest countries, that country has spent much of the past few decades in economic chaos, while its people were impoverished.

But if our own government cannot grow the economy and get public spending under control, it won’t be long before we, too, require a chancellor armed with a metaphorical chainsaw.

Published: [#item_custom_pubDate]