SIR Keir Starmer yesterday hinted he’s ready to heed the demands of Labour rebels and scrap the two-child benefit cap.

The PM gave his strongest indication yet that he will remove the threshold that limits handouts for a third kid.

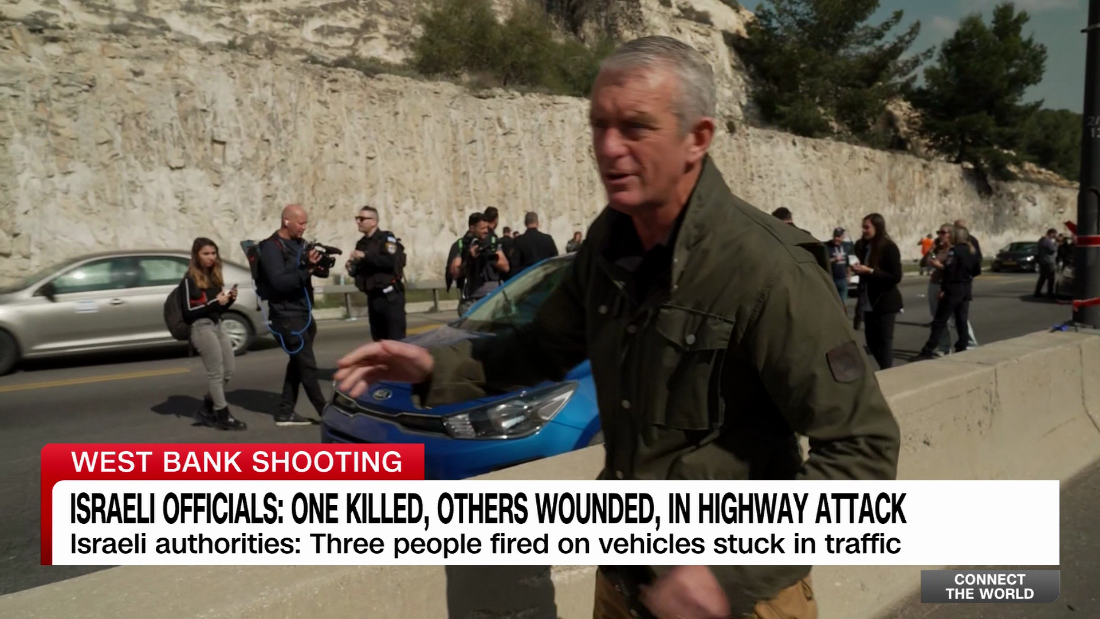

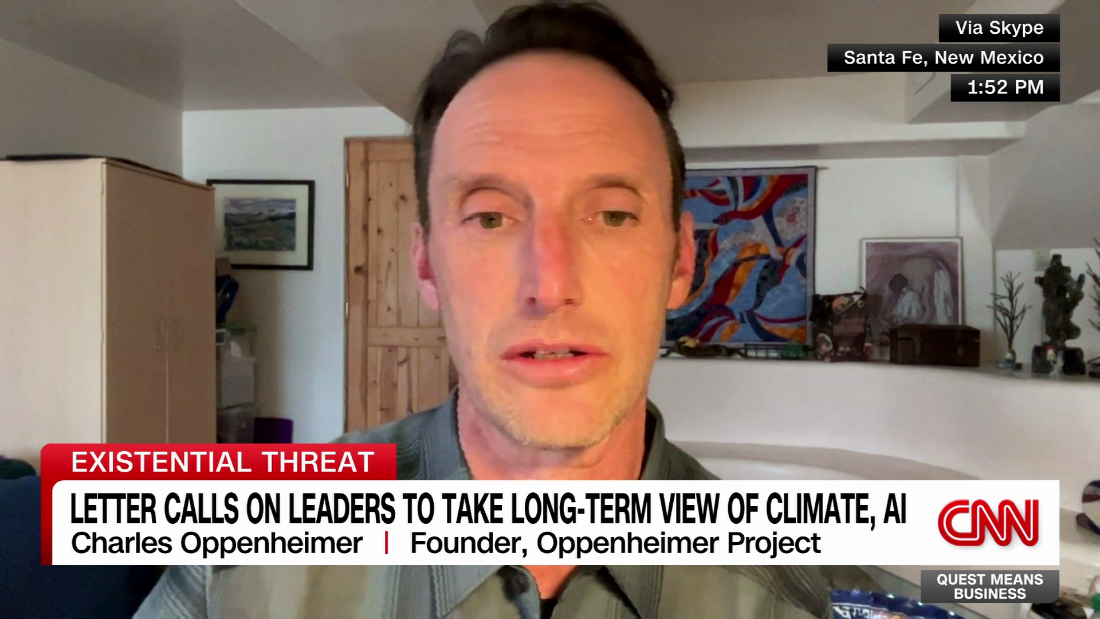

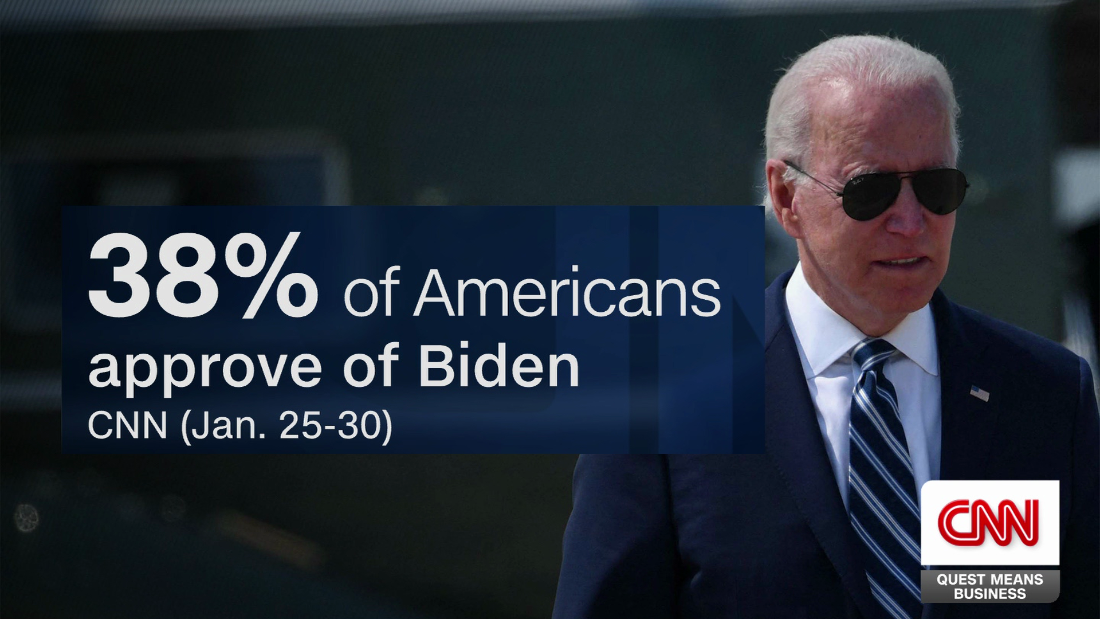

ReutersSir Keir Starmer today dropped his strongest hint yet that the two-child benefit cap will be abolished[/caption]

Laying the groundwork for a U-turn on his election claim the cap won’t be abandoned, Sir Keir said he was “determined to drive down child poverty”.

Visiting a glass manufacturing plant in Warrington, on three occasions he wouldn’t rule out a change in policy.

Amid growing pressure from furious backbench MPs, Sir Keir insisted ministers were “looking at all options” around tackling poverty among kids.

He said: “One of the proudest things that the last Labour government did was to drive down child poverty.

“I think there are a number of components — there isn’t a single bullet — but I’m absolutely determined that we will drive this down and that’s why we’ll look at all options, all ways of driving down child poverty.

“I’m so proud the last Labour government did it and I’m so pleased that we are taking up that challenge to do it with this Labour government and that’s what we will do.”

How to claim Child Benefit

Read below if you would like more information on how to claim child benefit.

Child benefit is worth up to £1,331 a year for your first or only child and up to £881 a year for additional children.

This works out at £102.40 every four weeks or £25.60 a week for your first child and £67.80 every 4 weeks or £16.95 a week for their siblings.

There is no limit on the number of children that can be claimed for.

Applying is straightforward and can be done in minutes at gov.uk or through the HMRC app.

Parents with a newborn baby should make a claim online as soon as possible and could then receive their first payment in as little as three days.

You can also backdate claims for up to three months.

Parents can make a claim and then choose to opt out of receiving Child Benefit payments can still receive National Insurance credits if one parent is not working.

National Insurance credits build up your entitlement to the state pension.

It comes as Shadow Chancellor Mel Stride this week warned Sir Keir has “no mandate” for scrapping the two-child benefit cap.

The top Tory blasted the PM for preparing to splurge billions on ditching another of his election pledges in sop to Labour lefties.

In the build up to July’s ballot, Sir Keir declared he wouldn’t abandon the cap, and didn’t include any policy around abolition in his party manifesto.

Furious Mr Stride said: “He promised he wouldn’t do it, but now it looks as though he’s going to break that promise and spend billions more.

“Reversing the cap isn’t just irresponsible, it’s unfair.

“Labour’s desperate U-turns show they can’t be trusted with your money.”

Chancellor Rachel Reeves is under huge pressure from Labour figures – including Gordon Brown – to lift the 2 child benefit cap, which limits the full benefits parents can get to two children.

Sir Keir is looking at lifting the cap after a revolt from his MPs – but it would cost around £3 billion a year.

With Treasury coffers running low, No11 is expected to have to raise taxes to pay for the benefit.

Last week Education Secretary Bridget Phillipson confirmed that abolishing the cap is “on the table”.

Asked whether ministers are planning to abolish the cap, Ms Phillipson told Times Radio: “It’s on the table.

“No measures are off the table.”

The Education Secretary added: “We’ve always been clear about that and of course social security is an important element of how we tackle child poverty.

“It’s not the only area. Childcare plays an important role, skills, how we ensure that more people are able to get back into work.

“There are lots of ways that the Child Poverty Task Force is considering how we can lift children out of poverty.

“But of course we can’t ignore the impact of social security changes, social security changes that were introduced by the Conservatives that a Labour government would not have introduced in the first place.

“But it’s tough, it’s challenging.”

Who’s exempt from the two-child benefit cap?

The two-child benefit cap means that you can only get more child tax credit or Universal Credit for your third (or more) child if:

They were born before April 6, 2017

They are disabled (disabled child element only)

You qualify for an exception in child tax credit or special circumstances apply in Universal Credit

You qualify for an exception or special circumstances for each third (or subsequent) child if:

You have adopted them or other children in your household

You receive guardian’s allowance for them or other children in your household

They are the second (or more) child born in a multiple-birth

They or other children in your household are the offspring of one of your children who is under 16 years old

They or other children in your household are not your child or stepchild, and you look after them under a court order

They or other children in your household are not your child or stepchild and you look after them under an arrangement with Social Services (except for formal foster care)

They were conceived as a result of rape, and you do not live with the perpetrator

Published: [#item_custom_pubDate]